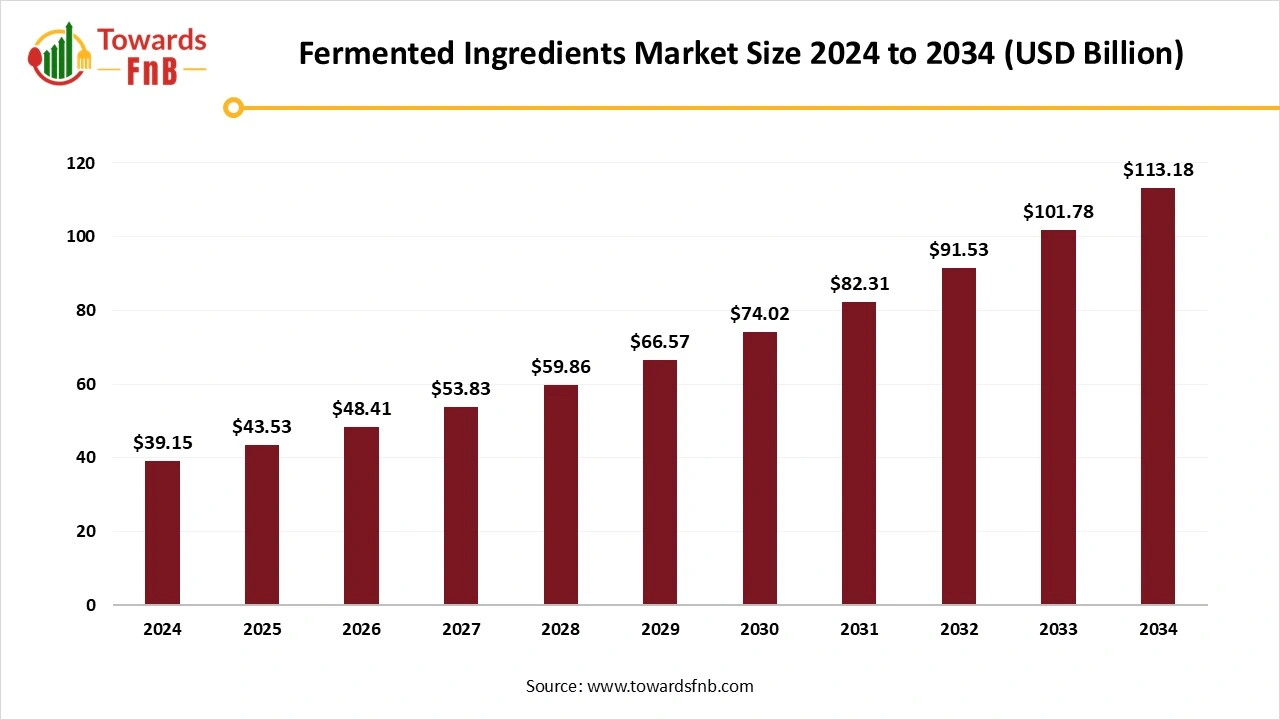

Fermented Ingredients Market Size to Worth USD 113.18 Billion by 2034, Driven by a CAGR of 11.2%

According to Towards FnB, the global fermented ingredients market size is evaluated at USD 43.53 billion in 2025 and is expected to grow USD 113.18 billion by 2034, reflecting a robust CAGR of 11.2% from 2025 to 2034. This growth is being driven by rising consumer demand for healthier, gut-friendly foods and increasing consumer education around the benefits of fermentation in promoting digestive health.

Ottawa, Oct. 15, 2025 (GLOBE NEWSWIRE) -- The global fermented ingredients market size was valued at USD 39.15 billion in 2024, with a forecasted growth trajectory from USD 43.53 billion in 2025 to USD 113.18 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research. This growth can be attributed to the rising preference for functional foods that support wellness and organic ingredients sought by consumers increasingly aware of the benefits of a balanced gut microbiome.

The market has experienced growth in recent periods due to increased consumer awareness about gut health and its importance for overall wellness. A healthy gut is the key to a healthy digestive system, making gut health essential for overall wellness. High demand for functional, organic, and gut-friendly food options among consumers is another major factor for the growth of the market.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5610

Key Highlights of the Fermented Ingredients Market

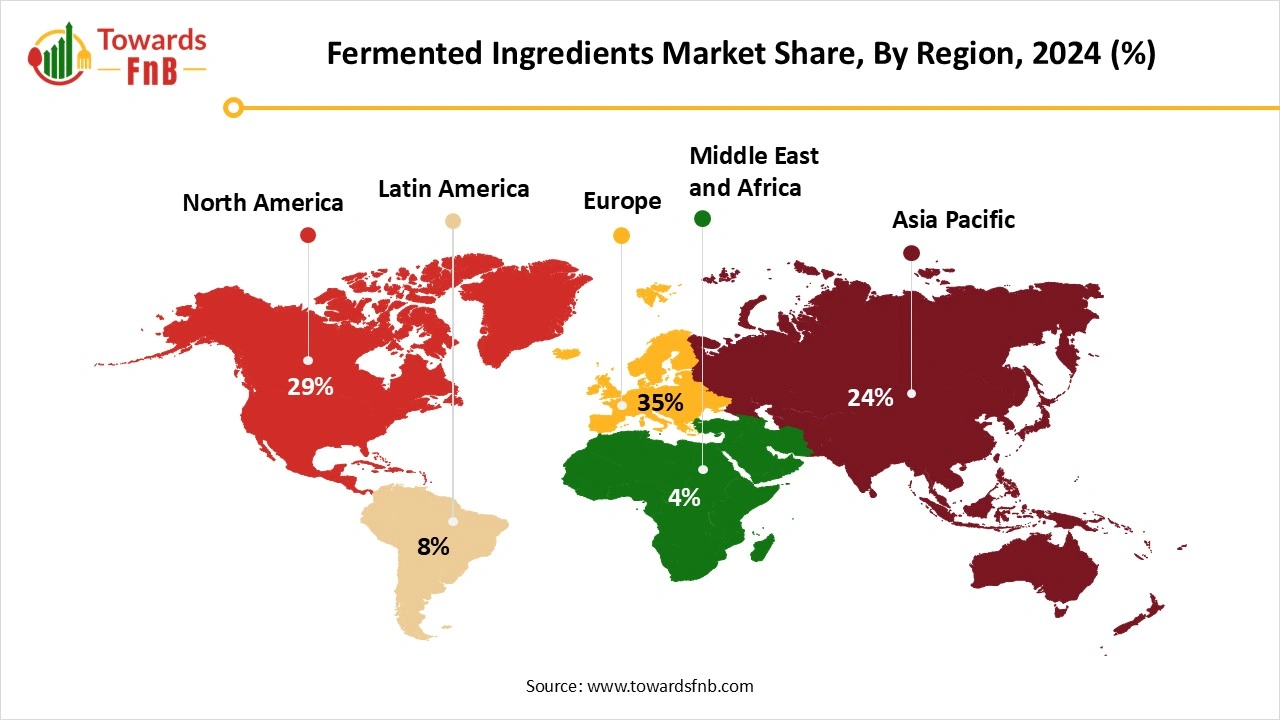

- By region, Europe dominated the fermented ingredients market with highest share of 35% in 2024, whereas the Asia Pacific is expected to grow in the foreseeable period.

- By product, the vinegar segment led the market with maximum share of 44% in 2024, whereas the cider segment is expected to grow in the expected timeframe.

- By application, the food and beverage segment dominated the fermented ingredients market in 2024, whereas the pharmaceutical segment is expected to grow in the forecast period.

High Demand for Healthy Options Fueling Growth of Fermented Ingredients

Higher demand for healthy, natural, and sustainable products is a major factor in the growth of the fermented ingredients market. High consumer awareness of improved gut health and its importance for overall health also fuels market growth. A healthy gut is essential for the proper functioning of the digestive system and overall functioning of the body. Hence, consumers' demand for functional, organic, and fermented food options and ingredients is further fueling the growth of the market.

Fermented ingredients are essential in the food and beverage industry but are also utilized in different other domains such as health and wellness, pharmaceuticals, and the cosmetic industry. Hence, the market has a huge consumer base formed by various demographic groups. The prevalence of diseases such as cancer, osteoporosis, diabetes, and strokes enhances the growth of functional food, which in turn fuels the growth of the fermented ingredients market. A deeper understanding of consumers' connection between the gut and brain for a healthy digestive system is another major factor helpful for the market’s growth.

Impact of AI in the Fermented Ingredients Market

AI is accelerating transformation in the fermented ingredients market by enabling smarter strain engineering, process optimization, and scalability, thus advancing how enzymes, probiotics, bioactive compounds, and functional proteins are produced. In microbial strain development, AI and machine learning models can predict which genetic edits or metabolic pathways will yield higher titers or improved stability, rapidly screening large combinatorial libraries of mutations in silico before lab validation. In the fermentation process itself, AI-driven digital twins and real-time sensor networks monitor variables like pH, dissolved oxygen, metabolite fluxes, and biomass growth, allowing dynamic adjustments to feeding schedules, agitation, or temperature to maintain ideal microbial performance.

This improves yields, shortens process times, and reduces batch failures. AI also assists downstream processes, separation, purification, drying, by optimizing buffer conditions, membrane parameters, chromatography steps, and yield recovery strategies. On the commercial side, AI models forecast demand for specific fermented ingredients across food, nutrition, and pharma sectors, helping manufacturers optimize capacity, raw material sourcing, and pricing strategies. Moreover, AI aids in screening safety and regulatory compliance by predicting off-target metabolites or byproducts and flagging potential toxicities or process hazards early. All told, AI is making the fermented ingredients market more efficient, innovation-driven, and scalable, lowering costs and accelerating time to market for high-value bioactive ingredients.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/fermented-ingredients-market

New Trends of Fermented Ingredients Market

- Higher demand for clean-label products, natural, organic products, and functional food options is one of the major reasons for the growth of the fermented ingredients market.

- Higher demand for fermented ingredients in the cosmetic industry due to their enhanced bioavailability also helps in the growth of the market.

- Enhanced technology helpful to enhance the benefits of fermented ingredients for improved gut health is another major factor for the market’s growth.

- Higher demand for fermented ingredients for cultured dairy products also helps to fuel the growth of the fermented ingredients market.

- Higher demand for fermented ingredients in the biopharmaceutical industry for therapeutic protein and vaccine creation also helps the growth of the market. The market is further fueled by higher demand for personalized nutrition and customization.

Recent Developments in the Fermented Ingredients Market

- In October 2025, Verley, a Lyon-based firm, launched a line of recombinant functional whey proteins named ‘FermWhey’. The procedure involved in manufacturing the new product is similar to beer brewing, but it uses microbes instead of cows. (Source- https://www.greenqueen.com.hk)

- In March 2025, Isobionics, a biotechnology brand of BASF Aroma Ingredients, launched two natural ingredients in the flavor market, namely, ‘Natural beta-Sinensal 20’ and ‘Natural alpha-Humulene 90’. (Source- https://www.basf.com)

Competitive Overview of the Global Fermented Ingredients Market

The fermented ingredients market features several global leaders, each playing a key role in shaping industry trends and technological advancements.

- Danone’s strategic use of probiotic fermentation technologies in its dairy line has made them a market leader in gut-health-focused foods.

- Novozymes and Chr. Hansen dominate the enzyme market, innovating continuously in fermentation technology to meet the rising demand for functional ingredients.

Product Survey for the Fermented Ingredients Market

| Category | Product / Example | Key Producers / Companies | Primary Function | Major Applications |

| Organic Acids | Lactic Acid, Citric Acid, Acetic Acid | Cargill, ADM, Corbion, Danone | Preservative, pH regulator, flavor enhancer | Beverages, dairy, bakery, and processed foods |

| Amino Acids | Glutamic Acid, Lysine, Tryptophan | Ajinomoto, ADM, Evonik, CJ CheilJedang | Nutritional supplement, flavor enhancer | Nutraceuticals, fortified foods, animal nutrition |

| Enzymes | Amylase, Protease, Lipase | Novozymes, DSM, DuPont, Chr. Hansen | Catalyze biochemical reactions, improve texture and flavor | Bakery, dairy, brewing, bio-processing |

| Vitamins (Fermented) | Vitamin B2, B12, K2 | DSM, BASF, Lonza, Kyowa Hakko | Nutritional fortification, metabolism support | Functional foods, supplements, infant formula |

| Polysaccharides | Xanthan Gum, Gellan Gum, Pullulan | CP Kelco, DSM, Kerry Group | Thickener, stabilizer, emulsifier | Sauces, dressings, dairy, beverages |

| Alcohols | Ethanol, Butanol | Cargill, ADM, Green Biologics | Solvent, flavor carrier, antimicrobial agent | Beverages, biofuels, and food preservation |

| Biopolymers | Polyhydroxyalkanoates (PHA), Polylactic Acid (PLA) | BASF, NatureWorks, Metabolix | Biodegradable packaging, film formation | Sustainable packaging, coatings, edible films |

| Flavors & Fragrances (Fermentation-derived) | Natural Vanilla, Ester Compounds | Givaudan, IFF, Symrise | Provide natural flavor and aroma profiles | Beverages, snacks, dairy, plant-based foods |

| Probiotics | Lactobacillus, Bifidobacterium, Saccharomyces | Yakult, Danone, DuPont, Chr. Hansen | Gut health enhancement, immune modulation | Yogurt, functional drinks, dietary supplements |

| Peptides | Bioactive Peptides | DSM, Evonik, Novozymes | Promote cardiovascular and skin health | Functional foods, nutraceuticals |

| Fermented Dairy Proteins | Whey Protein (Precision Fermented), Casein | Perfect Day, Vivici, Change Foods | Dairy alternatives, nutritional enhancement | Dairy substitutes, protein beverages, sports nutrition |

| Fermented Plant Proteins | Soy Protein, Pea Protein (Fermented) | Cargill, ADM, Nestlé, Danone | Enhanced digestibility, flavor improvement | Plant-based meat, dairy alternatives |

| Bioflavors & Aromatics | Fermented Heme, Natural Esters | Impossible Foods, Givaudan | Flavor generation and enhancement | Plant-based meats, savory foods |

| Fermented Lipids | Omega-3 DHA, Structured Fats | Corbion, DSM, Cultivated Biosciences | Nutrition enhancement, mouthfeel improvement | Infant nutrition, dairy alternatives, functional foods |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5610

Regions with Highest Demand for Fermented Ingredients

- Europe- Being the dominating market in 2024, Europe is one of the highest-demanding countries for fermented ingredients, further fueling the growth of the fermented ingredients market. The higher demand for fermented food options in the region, such as beer, sauerkraut, and sourdough bread, is another major reason for the growth of the market. Consumer awareness regarding the health benefits of fermentation, particularly for gut health, also helps in the growth of the market. Higher demand for food options such as cheese, wine, and yogurt also helps in strengthening the fermented ingredients market.

- North America- North America is also observed as a growing region for the fermented ingredients market. The consumers in the region have a high demand for functional, organic, and natural ingredients to improve and strengthen gut health. Hence, the market is observed to grow strongly in the region. Rising consumer awareness of the importance of a healthy gut for improved health is another vital factor driving market growth.

-

Asia Pacific- The region is observed as the fastest-growing for fermented ingredients in the foreseeable period. Rapid industrialization, growing demand, and supportive government policies are some of the major factors for the growth of the market in the region. Countries like India, China, and Japan are major contributors to the growth of the market in the Asia Pacific. The countries have a higher demand for fermented food and beverage options, and hence, the market is observed to grow in these regions.

Fermented Ingredients Market Dynamics

What are the growth drivers of the Fermented Ingredients Market?

Higher demand for functional, organic, and natural ingredients is a major factor in the growth of the fermented ingredients market. Consumer awareness regarding gut health and the mind connection is beneficial for a healthy digestive system, which also supports market growth. Fermented ingredients, due to their bioavailability, are also helpful for the cosmetic and pharmaceutical industry. Hence, higher demand for fermented ingredients by the mentioned domains is another major factor for the growth of the fermented ingredients market. Hence, such factors help the growth of the market.

Challenge

High Production costs and Quality Control are obstructing the Market’s Growth.

The fermentation ingredients require a higher production cost and proper and maintained control. Hence, such restrictions may slow the growth of the fermented ingredients market. The fermentation process requires bioreactors and specific microbial strains, which further adds to the market's expenses. Further requirements for large-scale commercialization, such as raw material supply, microbial efficacy, and current issues, are major factors obstructing the growth of the fermented ingredients market.

Opportunity

Technological Advancements are helping the growth of the Market

Technological advancements enhancing the fermentation industry are one of the major opportunities for the growth of the fermented ingredients market. Advanced bioreactor design and improved automation are some of the major factors adding to the growth of the market. The whole procedure is further adding to the growth of the market and enhancing the quality of food. Technological innovations such as precision fermentation, regulated microbial cultures, and bioengineering are essential for the mass production of stable and high-quality fermented ingredients.

Trade Analysis of the Fermented Ingredients Market

The global trade of fermented ingredients is experiencing significant growth, driven by increasing demand across various sectors, including food and beverage, pharmaceuticals, cosmetics, and nutraceuticals. Key exporting countries, including Germany, France, and the U.S., play a vital role in supplying high-quality fermented ingredients to emerging markets in Asia Pacific, Latin America, and parts of Africa, where demand is steadily increasing due to a shift toward health-conscious, gut-friendly foods.

Export Leaders:

- Germany leads the market in fermented ingredient exports, particularly in vinegar, enzymes, and probiotics, catering to both the EU and global markets.

- The U.S. is a major exporter of functional food ingredients and probiotics, especially to Asia Pacific and North America, where the demand for gut-health products is high.

- France and Italy export a wide range of fermented dairy products, such as yogurt, cheese, and fermented proteins, largely to the Middle East and Africa, where these products are gaining popularity.

Import Dynamics:

The Asia Pacific region, with China, India, and Japan being key markets, imports large quantities of fermented ingredients for use in local food production, health supplements, and pharmaceutical applications. These regions benefit from import tariffs that have been relaxed to promote the local fermentation industry, which is expanding at a rapid pace due to increased consumer interest in probiotic-rich foods and functional beverages.

Trade Challenges:

Despite the market's growth, the global trade of fermented ingredients faces challenges, including tariffs, regulations, and quality control. Different regions have varying regulatory standards, especially when it comes to labeling and health claims related to fermented foods, which can affect cross-border trade.

- For instance, the EU has stringent regulations on food safety and labeling, which can sometimes slow down the export of fermented products from other regions.

- Additionally, differing standards on the use of genetically modified organisms (GMOs) in fermentation processes pose trade barriers, particularly for countries in North America where GMOs are more common compared to European Union countries.

Regional Trade Agreements

Several regional trade agreements (RTAs) are helping streamline the flow of fermented ingredients. For example, agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) have opened doors for smoother trade between countries like Japan, Australia, and Canada. These agreements foster collaboration in research, innovation, and the development of fermentation technologies, making it easier to meet growing demand in these markets.

Sustainability in Trade

The demand for sustainable practices in fermentation is also affecting global trade. Many countries are focusing on sourcing sustainable ingredients, such as plant-based substrates for fermentation, which has influenced trade patterns. Countries with a focus on eco-friendly production are increasingly exporting these sustainable ingredients, benefiting from the growing trend of eco-conscious consumers in both developed and emerging markets.

Impact of Trade on Market Growth

The global trade of fermented ingredients is expected to further accelerate as manufacturers continue to leverage global supply chains to meet the surging demand for functional foods, probiotics, and natural ingredients. As the market grows, expanding trade networks, supply chain optimization, and evolving trade regulations will play a key role in market accessibility across regions. This will be crucial for meeting the growing need for sustainable and innovative fermented products in food, pharmaceuticals, and personal care industries.

Fermented Ingredients Market Regional Analysis

Europe Dominated the Fermented Ingredients Market in 2024

Europe dominated the fermented ingredients market in 2024 due to high demand for sustainable, natural, and functional bio-based components in food and beverage, cosmetics, and industrial uses. Advanced technology in the region, which enhances the fermentation industry for large-scale production, is also a major factor in the growth of the market in the region. Technologies such as microencapsulation help boost the market as well. Higher demand for various types of fermented food and beverage options, such as kombucha, kefir, fermented juices, and fermented vegetables, also contributes to the growth of the market. Germany has the highest contribution to the growth of the market in the region.

Asia Pacific is expected to grow in the Expected Timeframe

Asia Pacific is expected to grow in the foreseen period due to increased demand and production of fermented ingredients and food and beverage options, which support the growth of the fermented ingredients market. Countries like India, China, Japan, and South Korea have major contributions to the growth of the market in the region. Higher demand for healthier food options, such as functional, natural, and organic, in the region also helps in the growth of the market in the foreseeable period.

Fermented Ingredients Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 11.2% |

| Market Size in 2025 | USD 43.53 Billion |

| Market Size in 2026 | USD 48.41 Billion |

| Market Size by 2034 | USD 113.18 Billion |

| Dominated Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Fermented Ingredients Market Segmental Analysis

Product Analysis

The vinegar segment dominated the fermented ingredients market in 2024 due to its high demand in industries such as food and beverage, pharmaceutical, textile, and dyeing. The food and beverage industry uses the most vinegar for cooking, pickling, and salad dressings, which aids in preparing various cuisines and boosts market growth. The market also observes growth due to high demand from health-conscious consumers who incorporate vinegar in foods, which aids healthy digestion, supports weight loss, and offers various other health benefits. High demand for functional, organic, and natural food options further fuels the growth of the market.

The cider segment is expected to grow in the foreseeable period due to rising demand for low-calorie beverages and alcohol-based beverages. Cider is a fruit-based fermentation ingredient that helps maintain distinct flavors in beer and spirits, further boosting the growth of the market. Cider also serves as an ideal replacement for beer and malt drinks in various mainstream cultures, further boosting market growth in the foreseeable period.

Application Analysis

The food and beverage segment led the fermented ingredients market in 2024 due to the growing population, which is boosting the industry's growth. The growth is further fueled by rising demand for various fermented food and beverage options that help improve and strengthen gut health. Fermented ingredients and food options such as kombucha, kefir, fermented juices and vegetables, yogurt, and kimchi also help to boost the growth. Health-conscious consumers in search of gut-friendly options also help in the growth of the market.

The pharmaceutical segment is expected to grow in the foreseen period due to the innovation of new fermented products and ingredients, which will boost market growth. Amino acids, vitamins, associated compounds, and industrial enzymes are utilized by the pharmaceutical industry, further boosting the growth of the market. The increased use of fermented ingredients by the cosmetic industry is another major factor driving market growth.

Value Chain Analysis for Fermented Ingredients Market

1. Raw Material Procurement (Carbohydrate Feedstocks & Nutrient Inputs)

Fermentation-based production relies on sugar, molasses, starches, or agricultural by-products as primary carbon sources, along with nitrogen, micronutrients, and water. Feedstock quality, cost, and availability directly affect yield and production economics. Increasingly, manufacturers source sustainable or waste-based substrates (e.g., corn steep liquor, sugarcane molasses, or food waste hydrolysates) to reduce environmental impact and costs. Upstream value capture occurs through secure access to low-cost, high-purity substrates and integration with agricultural processors or biorefineries.

2. Fermentation & Processing

This is the core value-adding stage, involving microbial or enzymatic conversion using bacteria, yeast, or fungi to produce amino acids, organic acids, vitamins, enzymes, biopolymers, and flavor compounds. Process optimization, including strain engineering, bioreactor design, and downstream purification, drives efficiency and product differentiation. Capital intensity is high, but innovation in precision fermentation and metabolic engineering enhances yields and enables novel, high-margin products like plant-based proteins and functional ingredients. IP ownership and process control create strong competitive moats.

3. Distribution & End-Use Integration

Fermented ingredients are distributed to food, beverage, cosmetics, nutraceutical, and pharmaceutical manufacturers. Value lies in technical support, formulation guidance, and compliance documentation (GRAS, EFSA, or ISO certifications). Strategic partnerships with end-user industries accelerate product adoption and co-development of new applications. Distribution efficiency, storage stability, and supply reliability are crucial for scaling globally. The highest value capture typically occurs among companies integrating R&D, production, and B2B application support, such as DSM, Novozymes, and Cargill.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Personalized Nutrition Market: The global personalized nutrition market size is forecasted to expand from USD 17.92 billion in 2025 to USD 61.56 billion by 2034, growing at a CAGR of 14.7% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Fresh Produce Market: The global fresh produce market size is projected to grow from USD 3,707 billion in 2025 to approximately USD 5,653 billion by 2034. This anticipated growth represents a CAGR of 4.80% during the forecast period from 2025 to 2034.

Top Companies in the Fermented Ingredients Market

- Cultivated Biosciences: Develops fermentation-derived lipid ingredients that replicate the creamy texture of dairy fat, enabling the creation of rich and sustainable dairy alternatives.

- Chunk Foods: Uses solid-state fermentation to produce clean-label, plant-based whole-cut meats with authentic texture, flavor, and nutritional value.

- Danone: Integrates fermentation and probiotic innovation in its dairy, plant-based, and functional food lines, driving gut health and sustainable nutrition advancements.

- Nestlé: Leverages precision and microbial fermentation to create functional ingredients and alternative proteins, expanding its portfolio of sustainable and health-focused products.

- Perfect Day: A pioneer in precision fermentation, Perfect Day produces animal-free dairy proteins like whey and casein, used in ice creams, cheese, and nutritional products.

- Yakult Honsha: A global leader in probiotic fermentation, Yakult’s fermented dairy beverages promote digestive and immune health through its signature Lactobacillus casei Shirota strain.

- Archer Daniels Midland Company (ADM): Applies fermentation biotechnology to produce enzymes, amino acids, and flavor compounds, with a focus on sustainable nutrition and clean-label solutions.

- Cargill, Incorporated: Utilizes fermentation for bio-based ingredients, including sweeteners, emulsifiers, and cultured proteins, supporting circular and plant-based food systems.

- Change Foods, Inc.: Employs precision fermentation to produce real dairy proteins without animals, focusing on sustainable cheese and dairy ingredient innovation.

- Chr. Hansen: A biotechnology leader producing cultures, enzymes, and probiotics through controlled fermentation, serving the dairy, beverage, and dietary supplement industries.

- Imagindairy Ltd: Uses precision microbial fermentation to create animal-free milk proteins that replicate the functionality and nutrition of traditional dairy.

- Impossible Foods: Applies fermentation for heme production, the key ingredient in its plant-based meat products, enabling realistic flavor, aroma, and color.

- PepsiCo: Integrates fermentation-based flavor and nutrition technologies into its beverage innovation pipeline, enhancing functionality and natural ingredient sourcing.

- Precision Fermentation Dairy: Focuses exclusively on fermentation-derived dairy proteins, offering scalable and sustainable alternatives to traditional milk-based ingredients.

- Royal DSM: Develops fermented vitamins, enzymes, and flavor compounds, applying biotechnology to create sustainable and health-enhancing food ingredients.

- Vivici B.V.: A joint venture between DSM and Fonterra, Vivici specializes in precision fermentation dairy proteins, aiming to deliver sustainable, nutritious dairy alternatives.

-

DuPont de Nemours and Company: Through its Danisco division, DuPont produces fermented cultures, enzymes, and probiotics, supporting the growth of clean-label and functional foods.

Segments Covered in the Report

By Product

- Vinegar

- Cider

- Others

By Application

- Food and Beverages

- Pharmaceuticals

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5610

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse |

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Dietary Supplements Market: https://www.towardsfnb.com/insights/dietary-supplements-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.